Health insurance plans are essential for a number of reasons. Firstly, it acts as a financial buffer, covering the costs of medical treatments, from routine doctor visits to major surgeries, so you don’t have to worry about draining your savings or going into debt when unexpected medical issues arise.

Secondly, having health insurance means you’re more likely to get the care you need when you need it. Insured individuals often seek medical attention sooner, which can lead to early diagnosis and more effective treatment, ultimately improving health outcomes.

Health insurance also promotes preventive care. Many plans cover services like vaccinations, screenings, and regular check-ups, helping catch potential health issues before they become serious problems.

In many places, having health insurance is required by law. This ensures that everyone has access to necessary healthcare services, which helps alleviate the strain on public health systems.

Lastly, health insurance provides peace of mind. Knowing that you’re covered for medical expenses allows you to focus on your health and recovery without the added stress of financial worries.

In short, health insurance is vital for safeguarding your health and finances, making sure you can get the care you need, when you need it.

Reviewing and comparing health insurance plans can be overwhelming, but it’s crucial for finding the coverage that best suits your needs and budget. Here’s a guide to help you through the process:

Key Factors to Consider

Premiums

Review: The monthly cost you pay for the insurance plan. Higher premiums often mean lower out-of-pocket costs when you need care.

Compare: Balance premium costs with your budget and how often you expect to need medical services.

Deductibles

Review: The amount you pay out-of-pocket before your insurance starts to cover expenses. Plans with lower premiums usually have higher deductibles.

Compare: Consider how much you can afford to pay upfront in case of a medical need.

Copayments and Coinsurance

Review: Copayments are fixed amounts you pay for specific services (e.g., $20 for a doctor visit), while coinsurance is a percentage of the cost (e.g., 20% of a hospital bill).

Compare: Look at these costs for the services you use most frequently.

Out-of-Pocket Maximums

Review: The maximum amount you’ll pay in a year before your insurance covers 100% of your costs.

Compare: Lower out-of-pocket maximums are beneficial if you anticipate high medical expenses.

Coverage

Review: What services are covered? Does the plan include essential benefits like hospitalization, prescription drugs, preventive care, maternity care, and mental health services?

Compare: Ensure the plan covers your specific healthcare needs.

Network of Providers

Review: Check if your preferred doctors, hospitals, and specialists are in the plan’s network. Out-of-network care usually costs more.

Compare: If you have established relationships with certain healthcare providers, ensure they’re covered under the plan.

Prescription Drug Coverage

Review: Look at the formulary (list of covered drugs) to ensure your medications are included.

Compare: Different plans cover different drugs, so it’s essential to match this with your current prescriptions.

Additional Benefits

Review: Some plans offer extra perks like dental, vision, wellness programs, and telehealth services.

Compare: These benefits can add significant value, depending on your needs.

Steps to Compare Plans

Gather Information: Collect details on various plans offered by different insurers or through your employer.

Use Comparison Tools: Utilize online tools and calculators provided by insurance companies, healthcare marketplaces, or independent websites to compare plan features side by side.

Read Reviews and Ratings: Look at customer reviews and ratings to gauge satisfaction with the insurer’s service and claims process.

Consult an Expert: If needed, seek advice from insurance brokers or healthcare advisors who can provide personalized recommendations based on your situation.

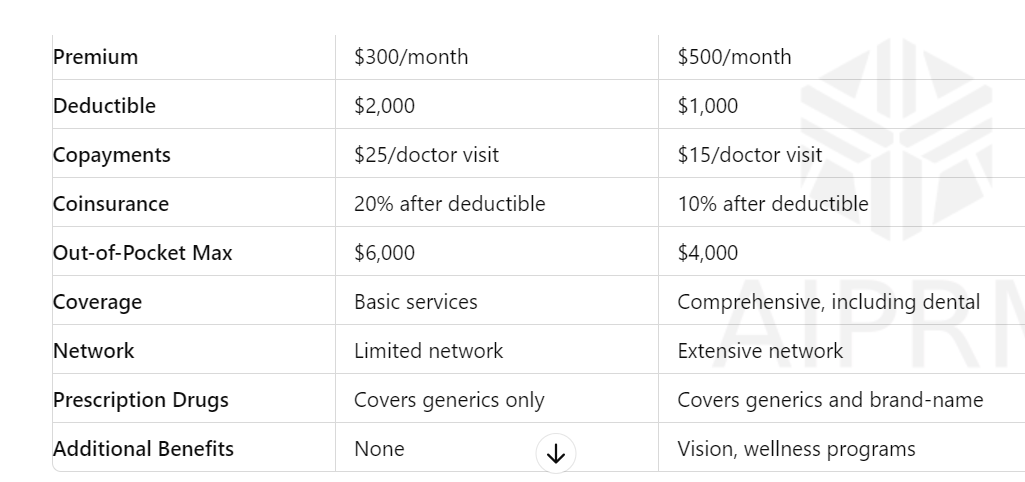

Example Comparison

In this example, Plan A has lower premiums and a higher deductible, making it suitable for someone who doesn’t anticipate frequent medical needs. Plan B, with higher premiums but lower out-of-pocket costs and additional benefits, might be better for someone who expects to use healthcare services more often.

By carefully reviewing and comparing these factors, you can select the health insurance plan that offers the best balance of cost and coverage for your needs.

Top Health Insurance Plans

When considering the top health insurance plans, it’s important to look at coverage options, customer satisfaction, network size, and additional benefits. Here are some of the top health insurance providers and their standout plans:

1. Blue Cross Blue Shield (BCBS)

Plan Highlights:

* Extensive nationwide network

* Comprehensive coverage option

* High customer satisfaction ratings

2. UnitedHealthcare

Plan Highlights:

Wide range of plans, including HMO, PPO, and EPO

Strong emphasis on wellness and preventive care

Access to a large network of healthcare providers

3. Kaiser Permanente

Plan Highlights:

* Integrated healthcare model with in-house doctors and hospitals

* High-quality care with a focus on preventive services

* Excellent customer service and satisfaction

4. Aetna

Plan Highlights:

* Variety of plan options, including employer-based and individual plans

* Extensive provider network

* Strong digital tools for managing health and insurance

5. Cigna

Plan Highlights:

* Global coverage options, ideal for international travelers and expatriates

* Comprehensive health and wellness programs

* Large network of healthcare providers

6. Humana

Plan Highlights:

* Specializes in Medicare Advantage plans

* Strong focus on preventive care and chronic disease management

* Additional benefits like dental, vision, and hearing coverage

7. Anthem

Plan Highlights:

* Wide range of plan options and coverage levels

* Access to the Blue Cross Blue Shield network

* Emphasis on preventive care and wellness programs

* Detailed Comparison

1. Blue Cross Blue Shield (BCBS)

Coverage Options: Individual, family, and employer-based plans

Network: Nationwide with extensive provider options

Additional Benefits: Wellness programs, telehealth services, and discounts on health-related products

2. UnitedHealthcare

Coverage Options: Individual, family, Medicare, and Medicaid plans

Network: Extensive, including nationwide and international providers

Additional Benefits: Health and wellness programs, mobile app, virtual visits, and health management tools

3. Kaiser Permanente

Coverage Options: Individual, family, and employer-based plans

Network: Integrated network with in-house providers and facilities

Additional Benefits: Preventive care services, personalized health plans, and comprehensive care coordination

4. Aetna

Coverage Options: Individual, family, Medicare, and employer-based plans

Network: Large network of doctors and hospitals

Additional Benefits: Wellness programs, mobile app, and online resources for health management

5. Cigna

Coverage Options: Individual, family, Medicare, and global health plans

Network: Extensive domestic and international provider network

Additional Benefits: Health coaching, wellness programs, and mobile app for health management

6. Humana

Coverage Options: Individual, family, Medicare Advantage, and prescription drug plans

Network: Large network with a focus on senior care

Additional Benefits: Health and wellness programs, chronic condition management, and additional coverage options for dental, vision, and hearing

7. Anthem

Coverage Options: Individual, family, Medicare, and employer-based plans

Network: Access to Blue Cross Blue Shield network

Additional Benefits: Wellness programs, telehealth services, and health management tools

Choosing the Right Plan

To choose the right health insurance plan, consider the following steps:

1 Assess Your Needs: Determine the level of coverage you need based on your health, family size, and expected medical expenses.

2 Compare Costs: Look at premiums, deductibles, copayments, and out-of-pocket maximums.

3 Check Networks: Ensure your preferred doctors and hospitals are included in the plan’s network.

4 Evaluate Additional Benefits: Consider extra perks like wellness programs, telehealth, and preventive care services.

5 Read Reviews: Look at customer satisfaction ratings and reviews to gauge the quality of service and support.

By carefully evaluating these factors, you can select a health insurance plan that offers the best balance of cost, coverage, and benefits to meet your needs.

Key Features to Consider

– Network coverage

Here’s a paragraph on “Network Coverage” in the context of health insurance:

“Network coverage refers to the extent of healthcare providers and facilities that are part of a health insurance plan’s network. A comprehensive network coverage ensures that you have access to a wide range of healthcare services and specialists, without incurring additional costs. When choosing a health insurance plan, it’s essential to check the network coverage in your area, including the number of primary care physicians, specialists, hospitals, and urgent care centers. A plan with a broad network coverage provides greater flexibility and convenience, allowing you to receive quality care from a provider of your choice while minimizing out-of-pocket expenses.”

– Deductibles and copays

Here’s a paragraph on “Deductibles and Copays” in the context of health insurance:

“Deductibles and copays are out-of-pocket costs associated with health insurance plans. A deductible is the amount you must pay annually before your insurance coverage kicks in. For example, if your deductible is $1,000, you’ll need to pay the first $1,000 of medical expenses before your insurance starts covering costs. Copays, on the other hand, are fixed amounts you pay for each healthcare service or prescription, usually at the time of service. For instance, you may pay a $20 copay for a doctor’s visit or a $10 copay for a prescription medication. Understanding deductibles and copays is crucial when selecting a health insurance plan, as they can significantly impact your overall healthcare costs.”

– Maximum out-of-pocket expenses

Here’s a paragraph on “Maximum Out-of-Pocket Expenses” in the context of health insurance:

“The maximum out-of-pocket (MOOP) expense is the highest amount you’ll pay for healthcare expenses within a policy year. It includes deductibles, copays, coinsurance, and other out-of-pocket costs. Once you reach the MOOP, your insurance plan covers 100% of eligible expenses for the remainder of the year. For example, if your MOOP is $5,000, you’ll pay $5,000 or less for healthcare expenses, and your insurance will cover any additional costs. Knowing your MOOP helps you budget for healthcare expenses and choose a plan that meets your financial needs. It’s essential to review your policy documents and understand your MOOP to avoid unexpected financial burdens.”

– Prescription drug coverage

Here’s a paragraph on “Prescription Drug Coverage” in the context of health insurance:

“Prescription drug coverage is a vital component of health insurance plans, providing financial protection against the high costs of medications. This coverage enables individuals to access necessary prescription drugs, such as medications for chronic conditions, without facing significant out-of-pocket expenses. Insurance plans typically have a list of covered medications, known as a formulary, which categorizes drugs into tiers with varying copays or coinsurance rates. Some plans may also have a deductible or require prior authorization for certain medications. By understanding the prescription drug coverage offered by your health insurance plan, you can better manage your healthcare costs and ensure access to the medications you need to manage your health.”

– Pre-existing condition coverage

Here’s a paragraph on “Pre-Existing Conditions Coverage” in the context of health insurance:

“Pre-existing conditions coverage refers to the extent of coverage provided by a health insurance plan for medical conditions that existed before the policy’s effective date. Many plans cover pre-existing conditions, but may impose a waiting period or exclude coverage for a specific period. Under the Affordable Care Act (ACA), insurance companies are required to cover pre-existing conditions without imposing exclusions or waiting periods. This means that individuals with pre-existing conditions, such as diabetes, hypertension, or asthma, can access necessary healthcare services without facing discrimination or financial burden. When purchasing a health insurance plan, it’s essential to review the pre-existing conditions coverage to ensure you receive the necessary care and treatment without any surprises.”

How To Choose The Best Plan For You

Assess Your Health Care Needs

Here’s a paragraph on “Assessing Your Healthcare Needs” in the context of health insurance:

“Assessing your healthcare needs is a crucial step in choosing the right health insurance plan. Take an inventory of your health status, medical history, and lifestyle to determine your healthcare requirements. Consider factors such as your age, gender, family size, and occupation. Do you have ongoing medical conditions or take prescription medications? Do you need regular check-ups or specialist care? Are you planning to start a family or have upcoming surgeries? By evaluating your healthcare needs, you can identify the type of coverage that suits you best, ensuring you receive the necessary care and treatment without breaking the bank. This assessment will help you make an informed decision when selecting a health insurance plan, providing peace of mind and financial protection for your healthcare expenses.”

Consider Your Budget of health insurance Plans

Here’s a paragraph on “Considering Your Budget” in the context of health insurance:

“When selecting a health insurance plan, it’s essential to consider your budget to ensure you can afford the coverage you need. Calculate your income and expenses to determine how much you can allocate towards premium payments, deductibles, copays, and coinsurance. Consider the out-of-pocket maximum and any additional costs associated with the plan. Your budget will help you decide between different types of plans, such as catastrophic, bronze, silver, or gold-level plans. By setting a realistic budget, you can avoid financial strain and ensure that your health insurance coverage provides financial protection without breaking the bank. Remember, it’s not just about finding the cheapest option, but also about getting the best value for your money.”

Research and Compare health insurance Plans

Here’s a paragraph on “Researching and Comparing Plans” in the context of health insurance:

“Researching and comparing health insurance plans is a crucial step in finding the right coverage for your needs. With numerous options available, it’s essential to carefully evaluate each plan’s features, benefits, and costs. Compare the premiums, deductibles, copays, and coinsurance rates of different plans. Look into the network of providers, prescription drug coverage, and any additional benefits, such as dental or vision care. Check the plan’s ratings and reviews from other customers and evaluate the insurer’s reputation. By conducting a thorough comparison, you can make an informed decision and choose a plan that aligns with your healthcare needs and budget. Don’t settle for a plan that doesn’t meet your requirements – take the time to research and compare, and find the best fit for your health and wellbeing.”

Read Review and Rating Of health insurance Plans

Here’s a paragraph on “Reading Reviews and Ratings” in the context of health insurance:

“Reading reviews and ratings from other customers is a valuable step in evaluating health insurance plans. Look for reviews on independent websites, such as Consumer Reports or eHealth, as well as on the insurer’s website. Pay attention to the overall rating, which is usually based on factors like customer service, claims processing, and coverage. Read the comments and feedback to get a sense of the pros and cons of each plan. Check if the insurer has any complaints filed against them with regulatory agencies. By reading reviews and ratings, you can get a better understanding of the insurer’s reputation, customer satisfaction, and the quality of service they provide. This information can help you make a more informed decision and avoid potential pitfalls when choosing a health insurance plan.”

Conclusion of health insurance Plans

“In conclusion, the journey to finding the right health insurance plan requires patience, research, and a thorough understanding of your needs. By following these steps, you’ll be empowered to make informed decisions about your healthcare coverage, ensuring access to quality care and financial protection. Remember, your health and wellbeing are priceless, and investing in the right insurance plan is a vital step towards securing your future. Take control of your healthcare journey today, and enjoy the peace of mind that comes with knowing you’re protected tomorrow.”

FAQs

Here are 5 FAQs related to health insurance plans:

Q: What is the difference between a deductible and an out-of-pocket maximum?

A: A deductible is the amount you pay before insurance kicks in, while an out-of-pocket maximum is the total amount you pay for healthcare expenses in a year, including deductibles, copays, and coinsurance.

Q: What is coinsurance?

A: Coinsurance is the percentage of medical expenses you pay after meeting your deductible, usually ranging from 10% to 30%.

Q: What is a network provider?

A: A network provider is a healthcare professional or facility that has a contract with your insurance company to provide discounted services.

Q: What is a pre-existing condition?

A: A pre-existing condition is a medical condition you had before applying for health insurance, which may be covered or excluded depending on the insurance plan.

Q: What is an open enrollment period?

A: An open enrollment period is a specific time frame when you can enroll in or change health insurance plans, usually occurring annually.